The COVID-19 pandemic has taken a huge economic toll on states across the country to varying degrees.

“Clearly, the housing market continues to surge, and things are looking up, more and more, for the U.S. economy in 2021, after a year of major setbacks in many sectors,” says Todd Teta, chief product officer with ATTOM Data Solutions. “But the pandemic still looms large and may pose a threat to the progress made so far, and by extension could affect home sales and prices.”

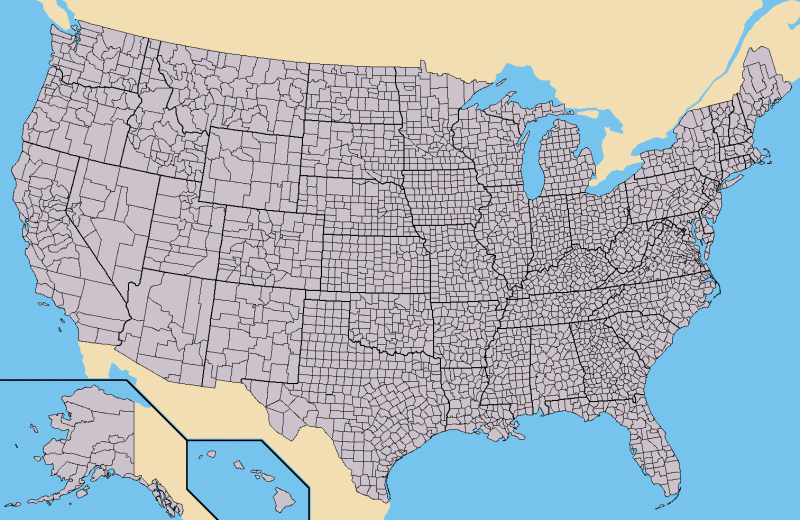

Pockets along the East Coast, Midwest, and South may be at highest risk from the ongoing pandemic, Teta cautions. The most vulnerable counties may be clustered around New York City, Chicago, and Southern Florida.

ATTOM Data researchers recently looked at 552 counties across the U.S. to rank whether they are more or less at risk based on the percentage of homes facing possible foreclosure, the portion with mortgage balances that exceeded the estimated property value, and the percentage of average local wages required to pay for home ownership expenses.

Several areas of the country are making it through the pandemic with strong economies. Twenty-two of the 50 counties least vulnerable to pandemic-related economic problems were in Colorado, Minnesota, Wisconsin, and Texas, according to ATTOM Data’s analysis.

Major homeownership costs—including for mortgage, property taxes, and insurance—comprised less than 30% of average local wages in 43 of the 50 counties that were at-least risk from the economic toll related to the pandemic in the first quarter of this year. The lowest risk counties were: Madison County (Huntsville), Ala. (14.2% of average local wages required for ownership costs); Sheboygan County, Wis. (16.1%); Muskegon County, Mich. (16.6%); Macomb County, Mich. (Detroit area) (16.7%); and Richmond City/County, Va. (16.9%).

On the other hand, homeownership costs comprised more than 30% of average local wages in 25 of the 50 counties found to be among the most vulnerable to pandemic-fueled economic problems. The highest percentages were in Beaufort County (Hilton Head), S.C. (43.6% of average wages were needed to cover major ownership costs); Sussex County, N.J. (40.6%); Manatee County (Bradenton), Fla. (39.9%); Kendall County, Ill. (Chicago area) (39.7%); and Ocean County, N.J. (New York City) (39.6%).

Source: ATTOM Data Solutions