Consumer sentiment gauge posted the largest two-month gain since 1991

Americans are rapidly becoming much more upbeat about the economy.

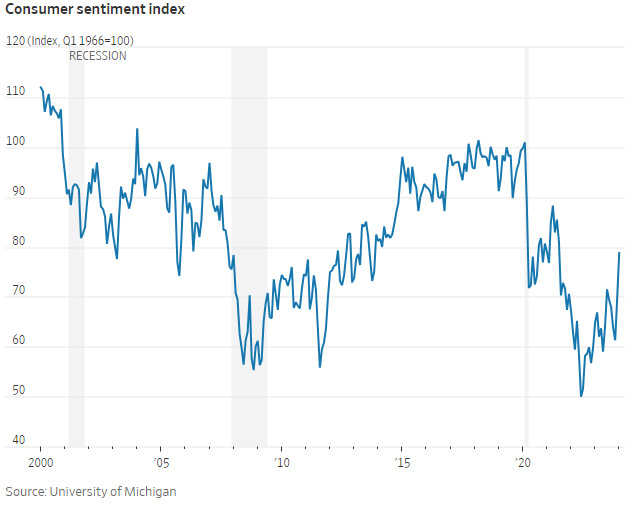

Consumer sentiment surged 29% since November, the biggest two-month increase since 1991, the University of Michigan said Friday, adding to gauges showing improving moods.

It’s a sharp turn after persistently high inflation, the lingering shock from the pandemic’s destruction and fears that a recession was around the corner had put a damper on feelings about the economy in recent years, despite solid growth and consistent hiring.

Now Americans are bucking up as inflation cools and the Federal Reserve signals that interest-rate increases are likely behind us. And with the solid labor market putting money in the bank accounts of freely spending consumers, recession fears for 2024 are fading.

Consumer sentiment leapt 13% in the first half of January from December, the Michigan survey said, after a sharp rise the prior month. The pickup in sentiment was broad-based, spanning consumers of different age, income, education and geography.

‘I can do more’

The recovery in sentiment “is likely to provide some positive momentum for the economy,” said Joanne Hsu, the Michigan survey’s director.

Despite the recent sentiment gains, the measure is still about 20% lower than before the pandemic took hold in 2020 and nearer to levels consistent with an economy just emerging from a downturn—not one that recorded surprisingly strong growth last year.

A drop in gasoline prices has encouraged Emma St. Onge, a college student from Springfield, Mass., because it means she gets to keep more of her money in her pocket, including what she earns from her part-time job on campus.

“I feel like I can do more because my money goes farther,” she said. “Hopefully people will start to struggle a little less, and therefore things will hopefully get better.”

A better mood among Americans is good for growth since happier consumers are, on balance, likely to keep spending—and that consumption drives around two-thirds of the U.S. economy.

Other gauges also show that Americans are at last emerging from their funk. The share of consumers in December who expected to be financially better off a year later reached the highest level since June 2021, according to a Federal Reserve Bank of New York survey. A separate consumer confidence measure last month saw its biggest one-month gain since March 2021, according to the Conference Board, a data provider.

What matters for voters

The state of the economy is the biggest political Rorschach test going into 2024.

Republicans have hammered President Biden on inflation and made economic issues central in their pitches to voters. Meanwhile, the Biden administration contends that its policies have led to a robust labor market, cooling inflation, stronger domestic supply chains and lower prescription-drug costs.

So far, the president appears to be losing the argument, as polling shows Americans’ indigestion about the economy is contributing to Biden’s low approval numbers. The Republican National Committee said earlier this month that “Bidenomics continues to cripple American families with historic prices,” referring to a moniker the administration has used for the president’s economic agenda.

Former President Donald Trump, the Republican front-runner, is touting his economic record. When he was in office, unemployment was also historically low and inflation tamer—before the sharp pandemic recession.

Steady improvement in Americans’ views of their economic prospects could bolster Biden’s re-election chances, if it means his message is breaking through, said Jesse Ferguson, a Democratic strategist.

“That doesn’t mean everything is great and everything is fixed,” he said. “But people see a path where the next day can be better than the last one, and that translates to some level of economic security.”

Signs of improvement

Several factors have combined to lift America’s economic spirits.

Unemployment is historically low, and hiring is still strong. What has changed is that inflation is cooling rapidly, while mortgage rates are down sharply from last year and the S&P 500 rose to a record high Friday.

“Confidence is picking up now because those things are going in the other direction and you still have a pretty good labor market,” said Neil Dutta, head of economic research at Renaissance Macro.

Consumers’ expectations for inflation a year ahead dropped to 2.9% in January, the lowest level since December 2020, and down from 4.5% in November, according to the Michigan survey.

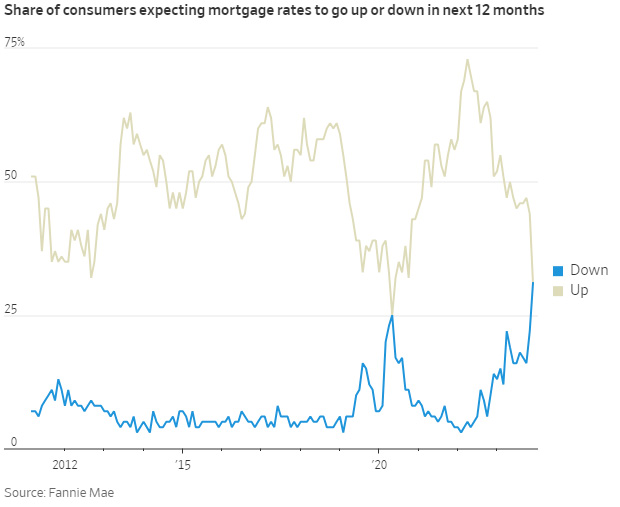

Fannie Mae’s index of home-buying sentiment jumped 10% in December from a year earlier. That was driven in part by a surge in the share of consumers anticipating lower mortgage rates over the next year.

Sentiment has improved markedly among households earning $100,000 annually or more, according to Morning Consult, a data-intelligence firm. That could be due to the stock market’s strong performance, since a greater share of higher-earning households owns equities compared with the share of lower-income Americans, said Sofia Baig, an economist at Morning Consult.

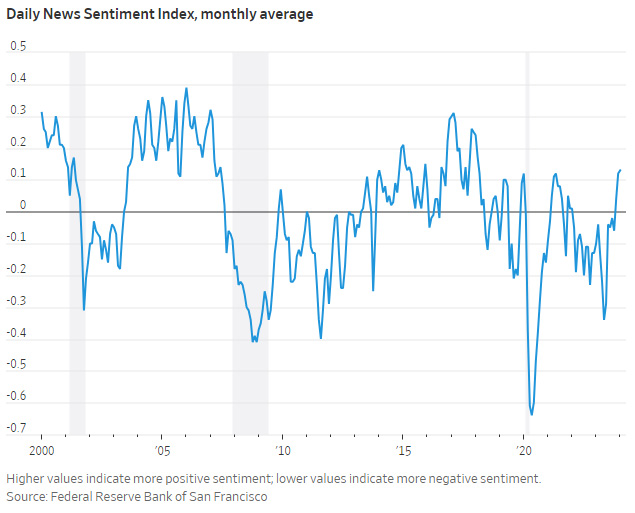

Media coverage might be rubbing off on consumers, too. The mood of economy-related articles has rebounded since November to the highest level since 2018, according to the San Francisco Fed’s Daily News Sentiment Index. Coverage had skewed much more negatively in the past three years relative to economic fundamentals, a Brookings Institution analysis found.

One reason sentiment is lower than what economic strength might imply is that consumers are still digesting the mid-2022 surge in inflation, said Neale Mahoney, an economist at Stanford University. He found that sentiment tends to recover just half of consumers’ initial negative reaction a year after prices increase.

Risks remain

But there are still risks to the economy and Americans’ moods.

While economists expect the U.S. to dodge a recession in 2024, they see growth slowing sharply as the full impact of the Fed’s interest-rate increases strain the finances of households and businesses.

That could weigh on consumers, particularly if unemployment starts to rise, said Jeremy Schwartz, senior U.S. economist at Nomura, who thinks a recession this year is more likely than not.

Inflation might prove more persistent and is subject to influence from global events such as wars in the Middle East and Ukraine. A flare-up in gasoline or food prices, or a stock-market dive could also depress sentiment.

Even a too-strong economy could make some Americans grumpy because it could encourage the Fed to keep interest rates elevated for longer. That makes it more expensive for Americans to finance homes, cars and appliances.

Source: wsj.com