Pending home sales fell last month as house hunters struggled against rising costs. Read more from NAR’s latest home sales report.

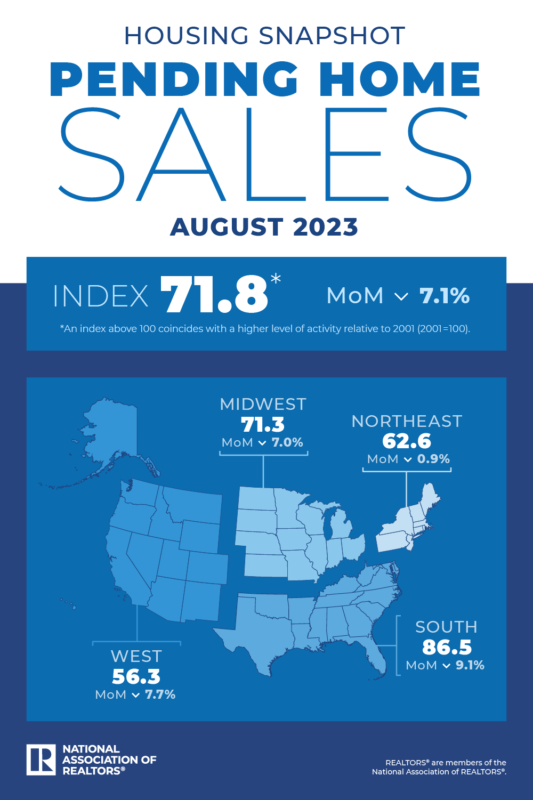

The National Association of REALTORS® reported Thursday that contract signings tumbled 7.1% month over month in August as mortgage rates float above 7%, pushing many aspiring home buyers to the sidelines. All four major U.S. regions saw monthly decreases, according to NAR. Pending home sales are down 19% from a year earlier. “It’s clear that increased housing inventory and lower interest rates are essential to revive the housing market,” says NAR Chief Economist Lawrence Yun.

Mortgage rates have been rising above 7% since August, which has diminished the pool of home buyers, Yun says. “Some would-be home buyers are taking a pause and readjusting their expectations about the location and type of home to better fit their budgets.”

Home shoppers also are grappling with higher home prices. The median price nationwide for an existing home rose nearly 4% year over year in August and has held above $400,000 for three consecutive months, according to NAR data.

New-home sales, which were a bright spot for the housing market recently, also dropped nearly 9% last month to their weakest level since March. Builders blamed elevated mortgage rates and challenging affordability conditions for the decline.

“Builders continue to grapple with supply-side concerns in a market with poor levels of housing affordability,” says Alicia Huey, chairperson of the National Association of Home Builders. “Higher interest rates price out demand, as seen in August, but also increase the cost of financing for builder and developer loans, adding another hurdle for building.”

Little Relief in Sight

Housing affordability fell in July as monthly mortgage payments climbed 18.4%, according to NAR’s latest Affordability Index. (At the time of the index’s last reading, mortgage rates were 6.92%.) At the same time, the median family income increased only 4.4%. The index showed that the typical family nationwide couldn’t afford a median-priced home.

In recent weeks, mortgage interest rates have reached the highest level since 2000, prompting loan demand to sink to a 27-year low, the Mortgage Bankers Association reported this week.

At its meeting last week, the Federal Reserve voted to pause increases to its benchmark interest rate but hinted at another hike before the end of the year.

“Overall, [mortgage] applications declined as both prospective home buyers and homeowners continue to feel the impact of these elevated rates,” says MBA Economist Joel Kan. Mortgage applications to purchase a home last week fell 27% lower than the same week a year ago, MBA reports.“The Federal Reserve must consider the sharply decelerating rent growth in its consideration of future monetary policy,” Yun says. “There is no need to raise interest rates. Moreover, the government shutdown will disrupt some home sales in the short run due to the lack of flood insurance or delays in government-backed mortgage insurance.”

Source: nar.realtor